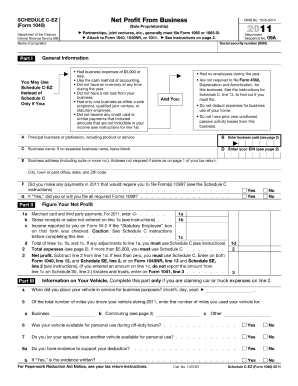

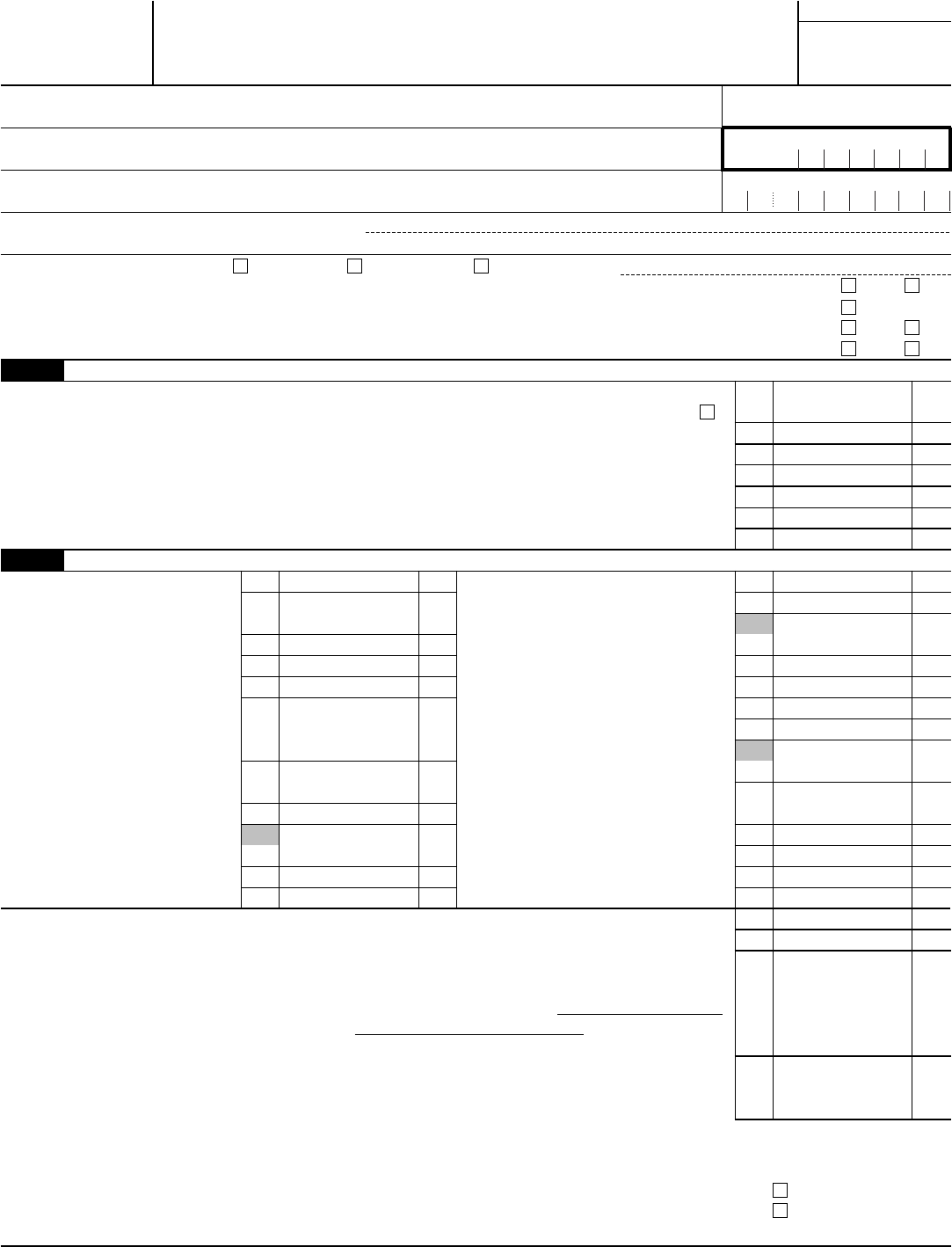

itemized deductions, which are taken on Schedule A (see ) when they exceed the standard deduction, or when married filing separately and the spouse also itemizes. These appear on lines 23-36 of Form 1040 (see ), and include such things as qualifying educator expenses, contributions to an IRA, moving expenses, and student loan interest.2. so-called "above the line" deductions, available to everybody regardless of whether or not they itemize. IRS Publication 17,, tells you everything that you'd ever want to know about the deductions and credits that are available to the US taxpayer.Writeoffs fall into several different categories:1. If you find that your net profit is large, then you should definitely start paying quarterly estimated taxes in 2014 (see Estimated Taxes).I'd suggest that you see a local tax professional, preferably one who has experience in preparing returns for small businesses, to help give you detailed guidance on your specific situation. The net income from this work will carry to your federal Form 1040, and you will follow the instructions to compute and pay the appropriate taxes (both income and self-employment).Assuming that you just started doing this work in 2013 and didn't have any requirement to file a return in 2012, I don't see any reason for you to take any other action at this stage. This doesn't need to be complicated - a simple spreadsheet will do - but come tax time you'll be glad you have that record.When it comes time to file your tax return, and assuming that you are a US citizen or resident alien, you will report your income and expenses from this work on Schedule C (Form 1040), Profit or Loss From Business. If you haven't been doing that, I suggest that you start now. What you should do, under these circumstances, is manage your work as though you were managing a business - which means keeping your own set of books, recording income and expenses related to that income.

First of all, when you work "off the books", so to speak, what you are actually doing is running your own business, with your skills as the primary product that you are selling.

0 kommentar(er)

0 kommentar(er)